The CMS Playbook: Five plays to nail multi-carrier delivery management

There’s been a sense of urgency before in retail but, knowing what we know now, it’s clear that what was once ‘urgency’ was actually pretty relaxed…

Projects have been moved up the priority list – most of which centre around ecommerce offering and shipping capabilities.

Having total control over fulfilment and delivery operations has never been more important. But it’s something that most retailers find challenging.

This playbook is absolutely packed with insight that you can steal – to help inform planning, strategy, business cases and proposals. Whether you’re looking for top level detail, or API documentation for a deeper dive into the tech – use and abuse the contents here to make your life easier. Each section breaks down each area that retailers need to know about enhancing and scaling carrier management. So, within this playbook, you’ll find:

- Chapter one – The market

Research and exclusive intel on current market conditions – for the retail and the courier industry. - Chapter two – The motive

Drivers and blockers for different carrier management models, including common challenges retailers come up against. - Chapter three – The models

Review of ownership over carrier programmes and where that sits within a retail business, plus a direct comparison of some benefits and challenges of different carrier management routes. - Chapter four – Five plays to get you started

Actionable tips for getting the most out of a CMS, with tipsnical API documentation, so IT teams can get a head start on the most effective ways to set up and get the most from the system. Each play is directly linked to tech - Chapter five – The summary

A wrap up of the playbook, with top takeaways and examples of retailers making big moves.

Ready?

Chapter 1 - The market

Consumers are rapidly changing their behaviour. Throughout 2020 and into 2021, we’re likely to see an uptake in delivery subscription services, loyalty boosted as consumers discover new brands online, increased ease of online shopping and demographic changes as older consumers adopt new channels and engage with ecommerce more.

And whilst the Marketing team focuses on the important task of converting customers at the checkout, of which delivery proposition plays a big part, the warehouse then has to deliver on that promise.

So, with all that shopping, comes all that shipping.

Logistics and operations teams are hit hard. Many have had to react quickly as ten years worth of transformation happens overnight. Businesses have been running at peak volume for over six months, with little let up – and analysts are unsure what shape Q4 seasonal buying will take this year. Stock movement is in uncharted water and last mile is under the spotlight.

Delivery is often the only physical touchpoint between a brand and the customer (and that’s never been truer than in a post-COVID world). Carriers make ecommerce, or break it. Performance is everything. And warehouse and logistics ops teams are responsible.

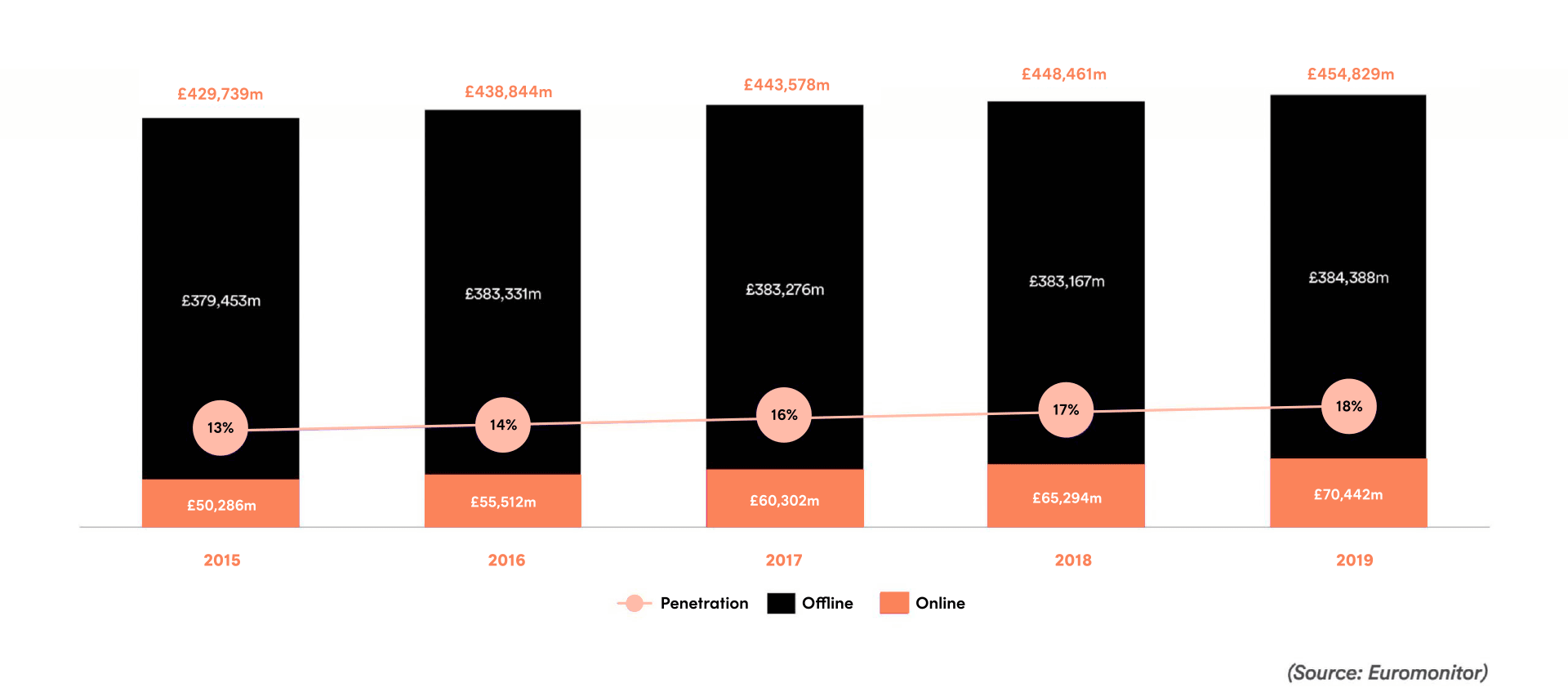

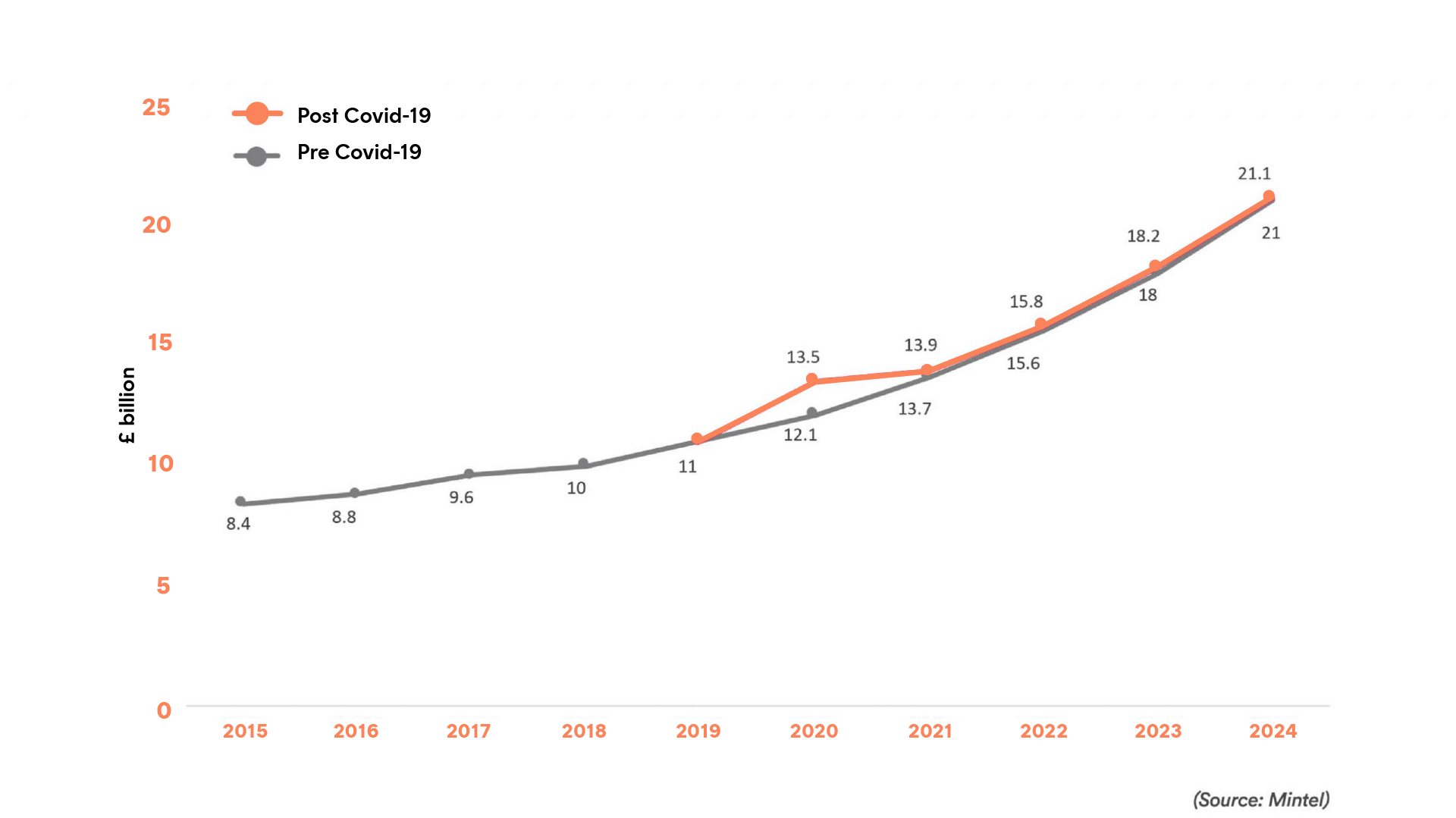

Forecasted Value of the UK Courier and Express Delivery Market, Pre- and Post COVID-19, 2015-2024

Our research found that although major global players in the carrier market are consolidating, the UK market is becoming fragmented with new entrants – mainly SME businesses entering the space as challengers. Between 2015 and 2019, the number of courier businesses in the UK rose by a whopping 57% (Mintel ‘Courier and Express Delivery Impact of COVID April 2020’), likely driven by hyperlocality, technology and specialist services.

International courier services are consolidating

But the uk last mile courier market remains highly fragmented with an increasing number of couriers entering the market

In 2019, there were 57% more courier businesses in the uk than in 2015

With acceleration like this, and consumer demand putting unprecedented pressure on the warehouse, there’s a massive opportunity for logistics leaders to take charge of the change. And there’s more choice than ever.

Warehouse mission: operational flexibility, at the lowest cost, with the lowest risk of disruption, in a logistics landscape in flux.

Easy.

Chapter 2 - The motive

Having a strong multi-carrier strategy to underpin growth is essential here. Routing all parcels through the same carrier, without question or query, isn’t a sustainable model for any retailer – especially if there’s a desire to capitalise on carrier market growth.

So, multi-carrier isn’t really an option in ‘the new world’; it’s a requirement for de-risking operations. But, in the interest of completeness, here are some of the blockers that ops teams often come up against:

- Managing relationship with one carrier is hard enough, how can we manage multiple?

- Carrier integrations are costly, how do we build a business case for the budget?

- How do I battle for IT resource for each carrier integration?

- Carrier integration maintenance is endless – rate changes, operational cut offs, collection times, new services – are IT too stretched to guarantee regular, timely upkeep work?

- Reporting is complex enough with one, how complex would it be with multiple carriers?

- Managing manifesting errors and delivery exceptions are already big tasks… what would it be like with more carrier complexity added?

Very valid concerns. But plodding along with one carrier is inherently risky. Here’s just a couple of the main issues:

- If they go down, you go down

If you have all your eggs in one carrier’s basket, and that carrier faces any disruption (due to tech failure or extreme weather, for example), you’re scrambled. No service, no shipping – and no carrier should be your single point of failure. - No negotiation power

If you’re negotiating rates with one carrier, you’re not negotiating at all – they know you need them more than they need you. Maintaining margin can only be done if you have a strong position in commercial conversations. - No optimisation of service type

Highlands and islands, or next day delivery for pre-10pm orders… with just one carrier, service offering is limited and there’s no ability to be smart with parcel routing. - Customers crave choice

It’s a major risk if your delivery offering doesn’t support carrier flexibility at the checkout. CX is crucial – and, to help the Marketing team convert, delivery offering has to be well-aligned to warehouse capability. - Nobody likes a full warehouse floor – or broken customer promise

Issues internally with picking and packing can cause retailers to miss carrier departure times. Mistakes happen – but, with no real carrier-driven issues, the warehouse is to blame for not delivering on customer promise. This can lead to stock build up, disruption of process and reduction of warehouse floor capacity – not to mention unhappy customers (and unhappy customer service teams). Flex is needed, so other services are on hand as plan B.

As the oracle of everything carrier and shipping related, the business looks to the warehouse and the operations team to deliver a carrier strategy that is both flexible and financially sound. That’s hard to do with just one partner, especially when you could tap into a market that’s growing exponentially.

Benefits of multi-carrier are very far reaching, but a few to mention:

- Order cycle time protection

Business continuity and output velocity can be maintained if the risk of carrier downtime is mitigated. One large fast fashion brand had downtime to the value of £50,000 when they were unable to ship for just one hour. Not good for customer promise, either. - More power for commercial conversations

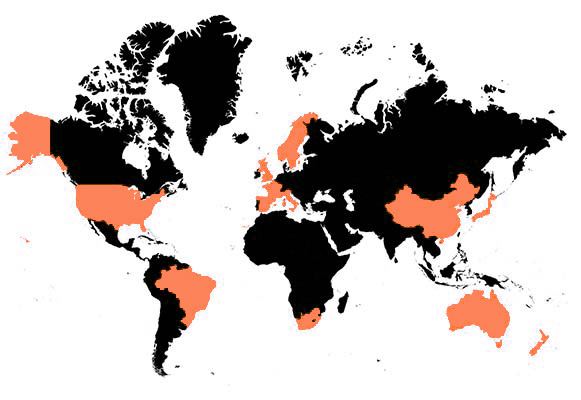

If you have options for fulfilling deliveries, volume splits can be used as a negotiation tool for rate card conversations. - Agile expansion

One carrier can’t deliver to the world. If a retailer has sights set on nationwide or international expansion, more carriers will enable growth in different territories - Service specialism

Dangerous goods, high value luxury, electronics, inner-city, remote residential – your service arsenal should be packed with options for specialist delivery. - Proactive rerouting

As soon as there’s a sniff of carrier performance dropping, whether it’s longer term change or in direct response to a severe and short term issue, there are fall backs to ensure customer promise is kept.

Whose problem is carrier integration?

At first glance: everybody’s.

Often, Marketing will drive demand for additional services, Ops will source and negotiate, IT will integrate and Customer Services will work with the carrier on tracking and final mile. But the two main players are Ops and IT – and carrier management can’t be done by one team in isolation.

Tech teams can be seen as the bad guys, sometimes. They hold the reins on project prioritisation, which can be frustrating for operations managers fighting for resource for rate changes. Carrier maintenance can be laborious, and onboarding even more so; it’s estimated that integrations can cost the business between £10k and £20k, with no ability to pilot or test before the work is complete.

Collaboration between the two teams can be light touch, but still impactful. IT should be brought into the selection process early on – whether it’s with carriers on a one-to-one integration basis or whether it’s through a third-party carrier management platform. They can offer expertise on which partner has the best documentation, which is the easiest tech to work with, which is the most agile, which has the most flexible API endpoints.

Early engagement of both teams eliminates any surprises of clunky, difficult tech blockers later down the line.

Chapter 3 - The Models

One-to-one carrier integration

The retailer has direct, bespoke-build integrations with each individual carrier. Services, reporting and configuration is managed directly with each business.

Benefits to Ops

- Direct integrations can be built independently in different ways to plug different services into different systems.

- Bespoke label configuration may be easier to

set-up directly with carrier integrations.

Wider business benefits

- If there is only one or two carrier services required on the roadmap, and extension of delivery proposition isn’t a business aim, no wider system changes are needed to integrate directly with carriers.

Key challenge

Changes must be made manually by the retailer IT team and in collaboration with each different carrier partner individually. So, if packaging dimensions change or your NDD cut-off time moves, that change has to be manually tweaked with each integration separately. Similarly, carriers very often make changes to their services (compliance, labels etc.) – and each change needs IT time to implement.

Using a carrier management system

Integrating once with a third-party CMS means all carrier integrations, maintenance and reporting is managed centrally through a specialist provider.

Benefits to Ops

- Access to thousands of carrier services that can be switched on and configured by the warehouse team.

- New services can be tried and tested easily, within warehouse control.

- Central helicopter view of reporting and carrier performance.

Wider business benefits

- IT resource freed up.

- Stronger negotiation position on carrier commercials and budget saving.

- Customer delivery proposition improved.

Key challenge

With some time and resource investment needed up front, proving ROI and building a business case can be tricky.

Some retailers are naturally averse to using third-party suppliers, particularly where past experiences have been negative. The CMS provider should always be aligned to retailer ambitions, with an innovative roadmap and the flexibility to tailor and support growth.

A CMS can have major and immediate impact on warehouse and logistics operations – as well as the wider business offering as a whole.

To get the most out of a new system, or even an existing one, we’ve put together some tips, tricks and tests that will help transform delivery ops into your secret weapon.

Chapter 4 - CMS: Five plays to get you started

Here are some examples of how a CMS can be used to optimise and improve management of a multi-carrier offering; empowering the warehouse to deliver so much more.

The following plays summarise some easy to implement changes that can be made with a CMS tech partner, and each section links to the technical documentation that would support an IT team, or operations team, to get stuck in.

Let’s get you growing.

Play one:

Customer promises the warehouse can keep

If you nail this, you’re winning.

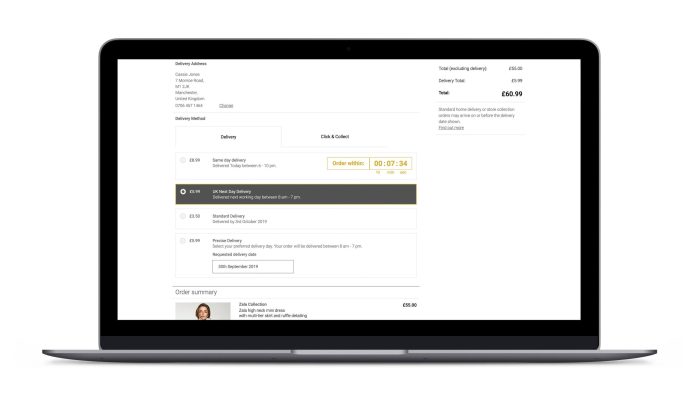

A CMS that connects the checkout and the warehouse will mean customer delivery options are based on operational and carrier capabilities – rather than just a static delivery offering, guesswork or, worse, making unrealistic delivery promises.

For example, not all carriers deliver to all postcodes at the weekend, so don’t offer that service to customers. Or bank holiday delivery isn’t offered by many carriers, so don’t offer that service to customers either.

If your web front end knows what’s going on in the warehouse, and with your carriers, there’s more chance of a smooth pick, pack, dispatch, final mile and happy customer.

It’s everyone’s problem if the customer delivery promise isn’t kept – but when warehouse ops are stretched and order cycle time is key, customer experience can feel like ‘someone else’s problem’.

That said, if the web front end and the DC talk to each other, a customer will be given multiple delivery options and the illusion of choice – but all within the tolerance of your ops, real-time.

Key takeaway

Customer delivery offering at checkout should always reflect what the warehouse can operationally fulfil. A CMS can link the web front end and the warehouse to ensure customer promise is kept, every time.

Play two:

Deciding how to ship

Routing to the cheapest available carrier service can shave off pence per delivery – for leaner and smarter budgets. Having multiple carrier services available means flexibility and control over which traffic goes where too.

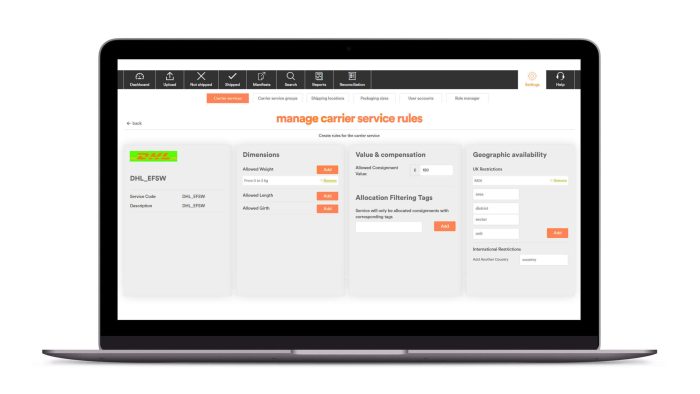

Allocation is seen as black magic. But you don’t have to be a developer to manage allocation rules.

Automated rules can be configured within the UI; meaning everything is visual and intuitive, rather than hard-coded – so, no IT resource needed.

Here’s an example of how a modern CMS might choose the right carrier for your shipment:

- Who can deliver?

First, the CMS compiles a list of all carrier services that could potentially take the consignment (that is, configured and enabled services that ship to the delivery address and could meet the specified delivery promise). - Who meets the allocation rules?

Next, the CMS creates a final shortlist of carrier services by eliminating any services that do not meet your retailer’s own allocation rules (your preferences on carriers able, or unable, to ship certain weights, dimensions or contents, for example). - Who is cheapest?

Finally, the CMS allocates the consignment to the cheapest service on the shortlist.

Key takeaway

Allocation rules and carrier preferences can be intelligently managed and automated by users within a CMS, with no complex coding or configuration needed.

Play three:

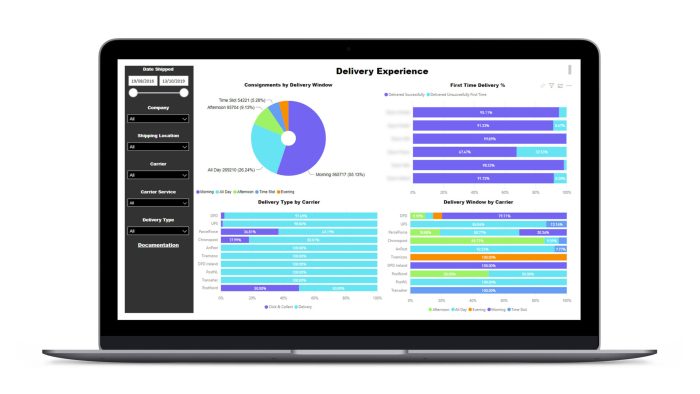

The delivery experience report

Managing insights and reporting from multiple carriers can be your secret weapon, or your downfall. You need one version of the truth.

It’s important to make sure you’re marking homework and proactively keeping on top of performance in as close to real-time as possible – not just you and your operations, but your carriers too.

A high performing CMS will put easily digestible, accurate data at your fingertips.

On top of standard reporting, creating a delivery experience report gives an overview of delivery types requested by customers, as well as how often carriers were able to meet those delivery promises. This, at the end of the day, is the juicy stuff that makes the operations team look awesome (or, shows you what needs to be fixed).

Important things to monitor:

- Carrier and carrier service

How many consignments were shipped via particular carriers or carrier services? - First time delivery success

What percentage of deliveries only needed one attempt at drop-off, and which carriers managed this most often? - Delivery window and type

Which were the most requested service types (such as click and collect or home delivery), and which carriers delivered successfully within those windows (such as morning, afternoon, all day or time slot deliveries)? - Shipping costs

What are your costs, drilled down by carrier and destination? How have shipping costs changed over time?

Key takeaway

Carrier performance and customer experience intel is a secret weapon, and it can be visible in a few clicks within a CMS reporting suite.

Play four:

Growth management

As the world changes, it won’t always be the case that one parcel ships to one customer from one DC by one carrier. Multiple carriers and multiple locations can be messy.

Maybe the business is acquiring other brands, moving into new warehouses, shipping from store estate or serving new international markets.

Warehouse ops shouldn’t be a blocker to business growth; they should be an enabler, leading seamless roll out of business expansion plans. So that’s where a CMS comes in; supporting a multi-location operation, and seamlessly managing complex shipping.

A CMS with a type of ‘order flex’ flow would enable you to process complex orders into easily shippable segments – meaning a simple way to manage one order that potentially comrpises items shipping from different locations, shipping on different dates or requiring multiple carrier services.– into easily-shippable portions.

This is particularly useful if:

- Ship from store is in your roadmap, or something you’re looking to explore.

- You ship multiple brands, with allocation rules specifically set for each – in a ‘parent and child’ shipping scenario.

- You operate multiple warehouses or fulfilment centres, or run a customer marketplace.

- You use drop ship vendors.

- You supply a range of products with large variations in weights and dimensions.

Key takeaway

Regardless of a retailer’s expansion roadmap, the CMS should support growth and enable innovation; offering simple solutions to complex challenges like multi-territory, multi-brand or multi-site fulfilment.

Play five:

Manifesting

Not the most exciting thing, and it should stay that way.

Manifesting is the hygiene factor that no-one wants to know about, until it goes wrong. And when it goes wrong, carriers charge, deliveries fail and customer promise isn’t met.

But it shouldn’t go wrong – and it shouldn’t be laborious. And this is a really simple, quick win for a CMS.

Collating, formatting and transmitting consignment data to carriers, in an old school model, is done on a consignment by consignment basis. Intelligent, multi-carrier teams are smarter.

For a modern operation, the process can be engineered so that shipments meeting pre-set conditions can be automatically manifested. And that can be super simple to manage within the CMS UI, so the control is totally with you.

For example, this could be done based on specific business need; such as manifesting eligible consignments to a certain carrier at a certain time, based on carrier collection times from the warehouse.

Key takeaway

Manifesting with a CMS can be as smart, or as simple, as required – and a CMS will ensure control of carrier data transfer sits within retailer ops teams.