Brands and retailers simply aren’t harnessing data in the right way. Here, we’ll explain how a smooth, reliable stream of actionable learnings can help inform your CX strategy and delivery ops.

With the ecommerce industry in a state of ‘do or die’, brands and retailers are competing more than ever for share of mind and wallet. It’s make, or break. But to create that essential competitive advantage, customer experience is everything. And post-purchase is the battleground.

So, how do brands and retailers drive the most efficient operations, that create the winning customer journeys? The answer is simple: a more informed business is a more successful business.

We spend a lot of time talking to our community of retailers and brands, and understanding how they’re using SortedREACT’s impressive data tools to provide business intelligence and insight about the most crucial customer journey; post-purchase and delivery.

Before we cover some of the valuable insight hidden in your delivery operations, it’s important to understand exactly what we mean by ‘insight’.

TWO TYPES OF INSIGHT

Daily management and monitoring.

Teams having access to the insight they need to do their jobs effectively and serve customers efficiently. This is often insight ‘by exception’, meaning that it isn’t necessary to see everything that’s going right, but business critical to see everything that’s going wrong.

Longer term insight to inform change.

Trend spotting and case building. This is the insight that you might not need for 10 months of the year – but when you need it, you really need it. This type of insight ensures business direction is aligned to customer need and behaviour on a larger scale.

Both types are important for adding value to your business at such a pivotal time in industry history. Retailers and brands should have total confidence in data accuracy, to ensure insights are trustworthy and reliable. For this, all post-purchase data should come through a partner who is directly integrated with carriers, rather than relying on scraping methods.

So, how can you use insight to add value to your business?

INSIGHT INTELLIGENCE IN ACTION

PERSONALISATION AND SEGMENTATION

Four out of five of consumers are more likely to purchase when brands offer personalised experiences… and it’s a safe bet that you’re not excited about losing a whole fifth of your customer base. Especially when it’s so simple to implement effective personalisation into the post-purchase experience.

With branded tracking pages or in-app tracking, you have a captive audience – and, according to Shopify, open rates on transactional emails (such as order confirmations or tracking updates) are as high as 90%. This is the perfect place to tailor your content to different personas or segments, capture customers and take those all-important insightful learnings.

Having insight to help you personalise effectively may include…

- Monitoring engagement with your ads and content across the full customer journey, particularly at those high traffic touchpoints such as delivery tracking pages. This will inform decisions on which ads perform best at post-purchase, as add on sale and upsell.

- Which of your demographics check their delivery tracking information the most? And on average how many times do they check it per shipment?

With this insight, and the right tools, you can monitor customer behaviour to fine tune your targeting.

BUILDING A BUSINESS CASE

Maybe you’re looking to make marginal gains, BAU optimisations, or maybe even large transformation initiatives.

Regardless, making changes to the customer journey, or internal operations and processes, requires time, resource and business buy-in. All three are easier to secure when driven by actionable insight, and you have the courage of your convictions.

CRISIS MANAGEMENT

Has there been a snowstorm on the Scottish borders? Has a closed motorway blocked all traffic in and out of Manchester? Is a Welsh carrier hub straining under lockdown demand?

No two days are the same in logistics, and having the insight to act fast is critical for protecting customer experience and building loyalty.

Using clever data tools, having this crisis intelligence is simple. By using clever automated alerting, CS agents get notified when there are shipment issues – meaning warnings such as ‘parcel is late’ or ‘parcel may be missing’ can be triggered, even if the carrier hasn’t yet passed over an update yet.

TREND SPOTTING

Monitoring day-to-day parcel operations is hygiene… having a longer-term view to accurately spot, and act on, trends is competitive edge.

This is where the longer term, historical insight access is so important. You might only need to pull a list of lost parcel deliveries from the North East of England once a year, but if you’re looking at geographical trends ahead of a busy peak period, you want that insight there and then.

So what kinds of insights could you be monitoring over time?

- Look closely at the metrics around which deliveries were early, on-time, or late. What are the common themes on those broken promises? You could also look at reviews and social media messages, to see whether there’s a correlation between those delivery performance metrics, and that influx of negative feedback.

FIXING, OR FINESSING, CX

A fifth of consumers recently surveyed said they are less likely to shop with a retailer or brand online again following a poor delivery experience – and a whopping 42% said they have missed deliveries due to miscommunication from the brand, retailer or carrier. It’s clear that this is an area that cannot be ignored.

A fully connected customer experience is the only way to differentiate in a busy, competitive market. In fact, our recent study of 60 retailer customer journeys found that 87% of retailers and brands are offering a customer experience that is average or below expectations – this leaves huge opportunity for retailers to move into a leading space occupied by only 13% of the market.

Using delivery insight to crack the connected CX challenge is simple – look at the way that customers are behaving and what their demands are. This will always give cues to how customer expectations are changing.

What might it look like?

- Which content or campaigns are resulting in an increase in website traffic? It’s proven that fully branded transactional emails (i.e. delivery communications) drive engaged traffic to site, but which calls to action are the most effective?

INFORMING CUSTOMER SERVICE TEAMS

Prevention is better than a cure. Retailers would much rather cut WISMO than serve WISMO.

But you can’t stop things from going wrong. And you can’t completely stop customers from needing to get in touch with your contact centre. So, when they do, it’s important to ensure teams are fully informed and have easy access to all the insight they need for quick first time resolution.

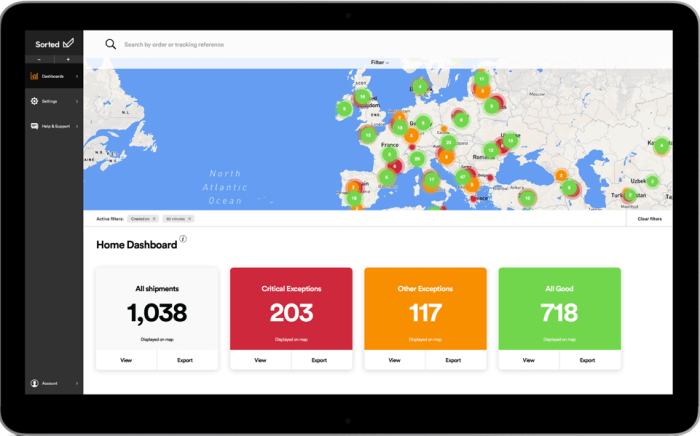

An interactive dashboard gives customer service and logistics teams the insight they need, and highlights issues by severity so prioritisation is clear. When a customer calls your contact centre with a WISMO or WISMR question, the agent dealing with the enquiry only needs to check one single place for all parcel details. So, no more switching between systems for different carriers or shipments.

CLEVER CARRIER OPS

Getting access to insight on carrier performance can be tricky. And when it comes to carrier reporting, it shouldn’t be down to the carriers to mark their own homework.

Having access to accurate data on your carriers’ delivery promise success rates is a huge plus here. Also, having detail such as ‘early’, ‘on time’ or ‘late’ parcel performance metrics means you’re fully in control and, ultimately, broken promises can be tracked and reduced.

So, what might that look like?

- Keep an eye on which carriers are meeting, or not meeting, customer promise most often. Compare that delivery success to your customer survey metrics, to see what the correlation is between broken delivery promises and a fall in NPS (or a rise, in line with kept promises of course).

If you want to know exactly how data tools can be used to tease out this hidden insight, check out our blog on how to get smart with delivery data, and add business value whilst you’re at it.

Introducing the SortedREACT trial.

To help customer service, carrier and ecommerce teams prove the value in post-purchase tracking software, we’ve created a simple 60 day FREE trial package.